2. From (Name and address of lender)

I

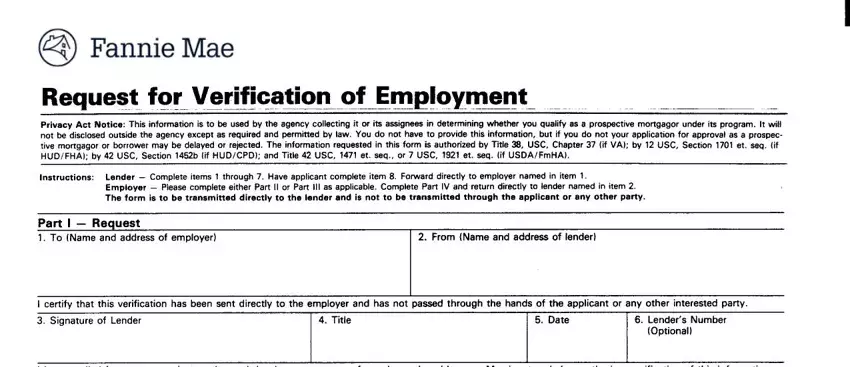

�FannieMae

Request fc,r Verification of Em�le>y_111ent

Privacy Act Notice: This information is to be used by the agency collecting it or its assignees in determining whether you qualify as a prospective mortgagor under its program. It will not be disclosed outside the agency except as required and permitted by law. You do not have to provide this information, but if you do not your application for approval as a prospec tive mortgagor or borrower may be delayed or rejected. The information requested in this form is authorized by Title 38, USC, Chapter 37 (if VA); by 12 USC, Section 1701 et. seq. (if HUD/FHA); by 42 USC, Section 1452b (if HUD/CPD); and Title 42 USC, 1471 et. seq., or 7 USC, 1921 et. seq. (if USDA/FmHA).

Instructions: Lender - Complete items 1 through 7. Have applicant complete item 8. Forward directly to employer named in item 1.

Employer Please complete either Part II or Part Ill as applicable. Complete Part IV and return directly to lender named in item 2.

The form is- to be transmitted directly to the lender and is not to be transmitted through the applicant or any other party.

Part I - Re uest

1. To (Name and address of employer)

I certify that this verification has been sent directly to the employer and has not passed through the hands of the applicant or any other interested party.

3. Signature of Lender4. Title5. Date 6. Lender's Number (Optional)

|

|

I have applied for a mortgage loan and stated that I am now or was formerly employed by you. My signature below authorizes verification of this information. |

|

|

|

7. Name and Address of Applicant (include employee or badge number) |

|

|

|

|

|

|

8. Signature of Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

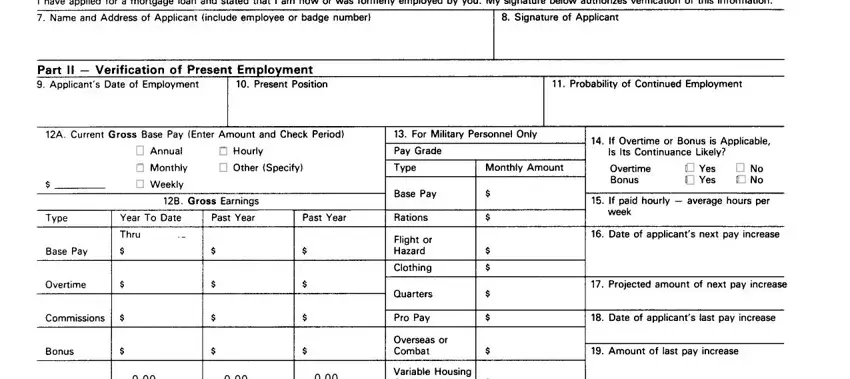

Part II - |

VenT1cat1on ofPresent |

|

Emp1oyment |

|

|

|

|

|

|

|

|

|

|

|

11. Probability of Continued Employment |

|

|

|

|

|

|

9. Applicant's Date of Employment |

|

|

|

10. Present Position |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12A. Current Gross Base Pay (Enter Amount and Check Period) |

|

|

|

13. For Military Personnel Only |

14. If Overtime or Bonus is Applicable, |

|

|

|

|

|

|

|

|

|

D |

Annual |

|

□ |

Hourly |

|

|

|

|

|

Pay Grade |

|

|

|

|

|

|

Is Its Continuance Likely? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

Monthly |

|

D |

Other (Specify) |

|

|

|

|

Type |

|

Monthly Amount |

Overtime |

|

D |

Yes |

D |

No |

$ |

|

|

|

|

|

C |

Weekly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bonus |

|

□ |

Yes |

□ |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base Pay |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

128. Gross Earnings |

|

|

|

|

|

|

$ |

|

|

|

|

|

15. If paid hourly - average hours per |

|

|

Type |

|

|

|

Year To Date |

|

Past Year |

|

|

Past Year |

19__ |

Rations |

|

$ |

|

|

|

|

|

week |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19_ _ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base Pay |

|

|

|

Thru __19_ |

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

Flight or |

|

$ |

|

|

|

|

|

16. Date of applicant's next pay increase |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hazard |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Overtime |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clothing |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

Quarters |

|

$ |

|

|

|

|

|

17. Projected amount of next pay increase |

|

|

|

Commissions |

$ |

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro Pay |

|

$ |

|

|

|

|

|

18. Date of applicant's last pay increase |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Overseas or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bonus |

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

Combat |

|

$ |

|

|

|

|

|

19. Amount of last pay increase |

|

|

|

|

|

|

|

Total |

|

|

|

$ |

0.00 |

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

|

Variable Housing |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

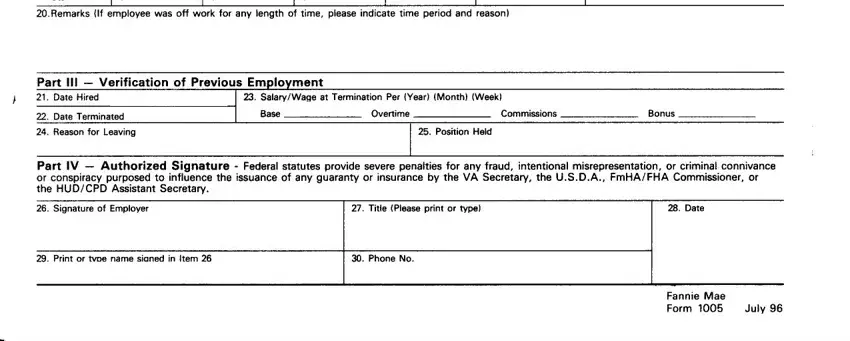

20.Remarks (If employee was off work for any length of time, please indicate time period and reason) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part Ill - Verification ofPrevious Em lo ment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. Date Hired |

|

|

|

|

|

|

|

|

|

23. Salary/Wage at Termination Per (Year) (Month) (Week) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base |

------- |

Overtime |

------- |

Commissions |

|

|

|

Bonus |

|

|

|

|

|

|

|

|

|

|

22. Date Terminated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24. Reason for Leaving |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

125. Position Held |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part IV - |

Authorized Signature - Federal statutes provide severe penalties for any fraud, intentional misrepresentation, or criminal connivance |

or conspiracy purposed to influence the issuance of any guaranty or insurance by the VA Secretary, the U.S.D.A., FmHA/FHA Commissioner, or |

the HUD/CPD Assistant Secretary. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28. Date |

|

|

|

|

|

|

|

|

26. Signature of Employer |

|

|

|

|

|

|

|

|

|

|

|

|

27. Title (Please print or type) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29. Print or type name signed in Item 26 |

|

|

|

|

|

|

|

|

30. Phone No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fannie Mae |

|

July 96 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 1005 |

|

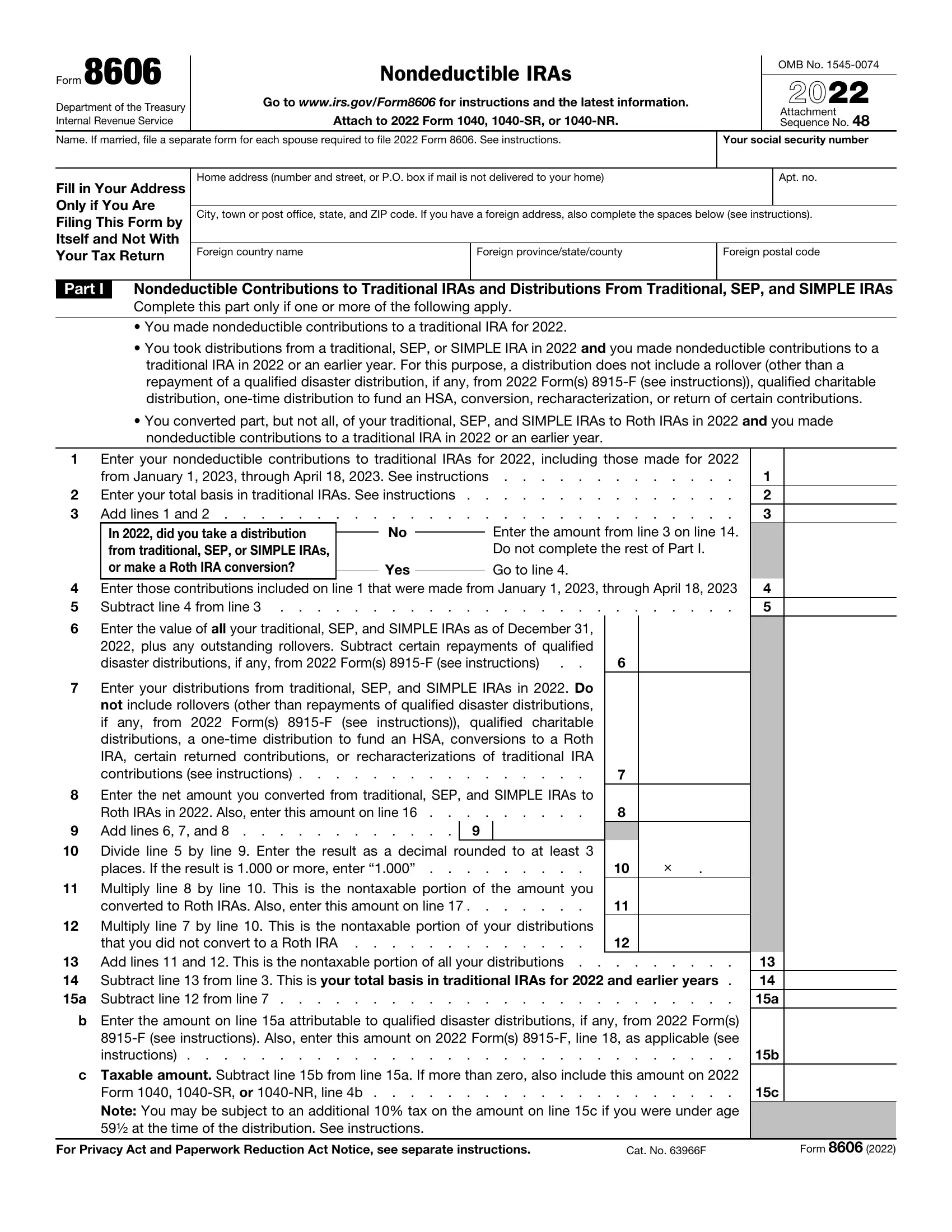

Instructions

Verification of Employment

The lender uses this form for applications for conventional first or second mortgages to verify the applicant's past and present employment status.

Copies

Original only.

Printing Instructions

This form must be printed on letter size paper, using portrait format.

Instructions

The applicant must sign this form to authorize his or her employer(s) to release the requested information. Separate forms should be sent to each firm that employed the applicant in the past two years. However, rather than having an applicant sign multiple forms, the lender may have the applicant sign a borrower's signature authorization form, which gives the lender blanket authorization to request the information it needs to evaluate the applicant's creditworthiness. When the lender uses this type of blanket authorization, it must attach a copy of the authorization form to each Form 1005 it sends to the applicant's employer(s).

For First Mortgages:

The lender must send the request directly to the employers. We will not permit the borrower to hand-carry the verification form. The lender must receive the completed form back directly from the employers. The completed form should not be passed through the applicant or any other party.

For Second Mortgages:

The borrower may hand-carry the verification to the employer. The employer will then be required to mail this form directly to the lender. The lender retains the original form in its mortgage file.